All goods that are moved across the border must go through customs declaration. To do this, a declaration is submitted to the FCS, where each imported or exported product is assigned a specific code of the Commodity Nomenclature of Foreign Economic Activity. Let's figure out what you need to know about the TN VED codes, how the classification of goods works and how to correctly fill out the code in the customs declaration.

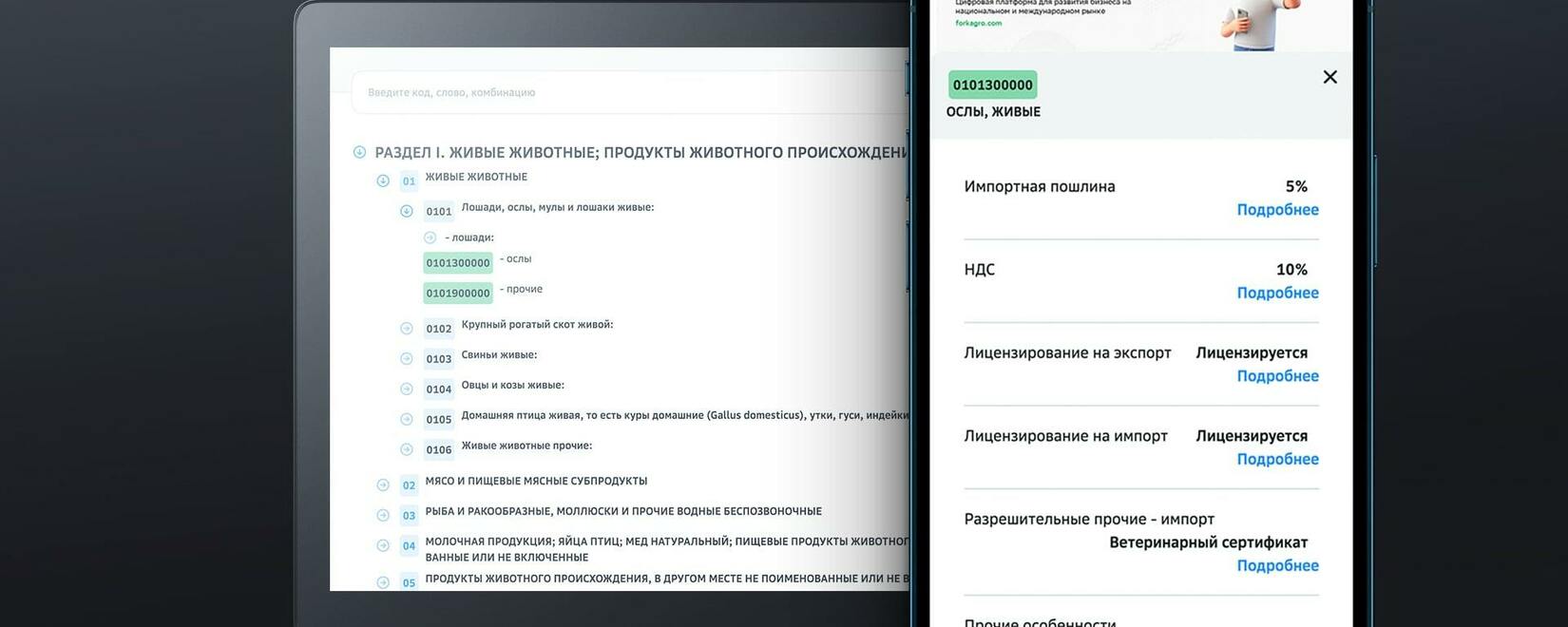

The TN VED code of the EAEU is a classification code for the unified commodity nomenclature of foreign economic activity of the Eurasian Economic Union. The code structure is based on the decimal system and includes:

group code - the first two digits of the code;

commodity item code - four digits;

subposition code - six digits;

subheading code - ten digits.

For example, let's take the product "pine firewood".

It corresponds to the code 4401 11 000 1 according to the FEACN, where:

group 44 - "Wood and products from it ...",

item 4401 - "fuelwood in the form of logs, logs ...",

subheading 4401 11 - "conifers",

subheading 4401 11 000 1 - "fuelwood in the form of logs less than 1 m long or split logs and logs".

Why do we need a commodity nomenclature for foreign economic activity

The economy of almost any country involves the import and export of several thousand different categories of goods. To regulate foreign trade, it is necessary to distinguish one product from another. Therefore, a list of goods ordered in a certain way was needed. For this purpose, the TN VED was created - a systematized form of a list of goods circulating in foreign trade. Thanks to the product nomenclature, it is easy to find, for example, apples in the Food or Plant Products groups, and cars in the Machines or Vehicles groups.

Trading platform

Trading platform

Monitoring

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory